“2020 has been a difficult year.”

You’d be hard-pressed to find someone who disagrees with that statement. Many people have lost their jobs. Parents have turned their homes into virtual classrooms. And families have been forced to stay away from hospitals, even though their loved ones are inside.

Times are tough, and you may be hesitant about giving to charity this year. But thanks to the Coronavirus Aid, Relief, and Economic Security Act — also known as the CARES Act — there are more reasons than ever to give.

Lawmakers understood that during a crisis humanitarian needs go up … while at the same time the number of people giving to those needs go down. So, they added extra tax breaks and incentives to the CARES act so that you can still feel financially confident while donation to the causes important to you this year.

Here’s what you need to know about how the CARES Act could help you save money on your taxes when you donate help rescue people in need by Dec. 31:

Deductions for almost every taxpayer

According to the CARES Act, almost every taxpayer can now take a deduction for up to $300 in charitable giving. This incentive used to just be for people who itemized their taxes. But not this year! Now, you can still claim the standard deduction plus up to an extra $300 when you make that donation you’ve been thinking about.

No deduction limit on cash gifts

If you do choose to itemize, only 60 percent of your Adjusted Gross Income (AGI) could be donated as cash contributions and eligible for tax deductions in the past. However, there are no limits in 2020. Every penny of your cash gifts made to charity this year, up to 100 percent of your AGI, can be deducted from your taxes.

Benefits for retirees

The new law no longer requires retirees to withdraw a minimum distribution amount from retirement accounts. However, your retirement account is still a great asset to donate from. If you were planning to give to a particular cause, you can donate from your retirement account instead of cash and save that cash for another personal need or financial goal. If you’re over the age of 70½, you can give up to $100,000 from an IRA account without having to pay taxes on it. This can save you money from hidden taxes and fees that are based on adjusted income.

Higher deductions for businesses

If you own a business and would like to make a donation from your company, this year is the year to do it! Tax-deductible cash gifts for corporations used to be limited to 10 percent of the company’s modified taxable income. But in 2020, that number has risen to 25%. Companies can also donate up to 25 percent of food inventory for a deduction, and World Help will make sure that any non-perishable food is shipped to families in need around the world.

Tax break for 100% of exercised stock options

If you’re an executive who receives stock options or restricted share units as part of your compensation, you may be able to exercise those stock options and — this year only — not have to pay federal income taxes on them when you donate the proceeds as a charitable gift. This is a huge benefit since taxes could eliminate close to half of proceeds in the past. The CARES Act allows you to donate much more to the causes you care about.

No capital gains tax for non-cash gifts

This benefit technically isn’t new, so you can continue to use this money-saving giving strategy for years to come! When you donate real estate, appreciated stock, or other non-cash gifts, you can avoid paying capital gains tax on those assets. World Help typically won’t have to pay taxes on them either, meaning the full value of your gift goes to help people in need.

There’s no doubt the coronavirus pandemic has brought many challenges this year, and many people around the world are struggling to survive. From starving children to persecuted Christians begging for a Bible, these people can’t afford to wait much longer.

That’s why we can’t stop giving in 2020.

Thankfully, the CARES Act is providing many opportunities to make a difference. If you’d like to learn more about how YOU can give creatively, visit us online or call 800-541-6691.

Recent stories on our blog

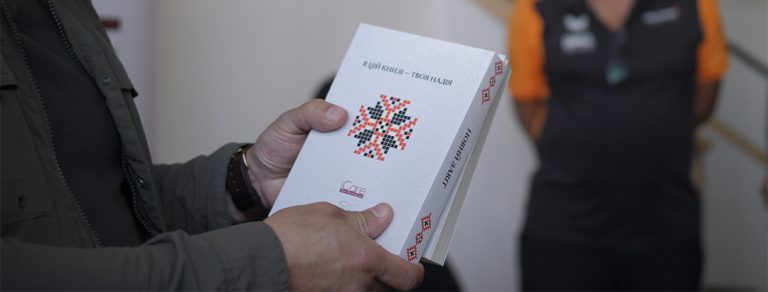

This Ukrainian Man is Unrecognizable After Reading the Bible!

I recently heard a story about a man in Ukraine and felt an . . .

5 Prompts for Your First Letter of 2024!

It’s hard to believe we’re already halfway through January . . .

How Svitlana Found Comfort During War

Recently, Bibles for All Ambassadors helped send Bibles to . . .